Previous Clients

meet

James Morris, Jr. is a Chicago native, serving as an economist in the federal government, an investor, and a mentor for aspiring property owners. Holding a Bachelor's degree in Economics from the University of Illinois at Urbana-Champaign, he embarked on his investment journey at 24, leveraging his initial property to venture into commercial multi-family real estate.

As a financial literacy coach and father of three bright children – Langston, Kamden, and Kerrington – James prioritizes imparting financial literacy, property ownership, and generational wealth principles. Inspired by this mission, he authored a series of children's books highlighting diverse characters, aiming to instill crucial financial concepts and inspire a new generation towards financial independence. Additionally, James teaches seminars for aspiring and future landlords, sharing his expertise and experience in the real estate industry.

Financial Literacy for Children

Introduce children to the fundamentals of money management, teaching them valuable skills such as budgeting, saving, and understanding the importance of financial responsibility from an early age.

Financial Literacy for Families

Equip families with the knowledge and tools necessary to effectively manage finances, budgeting, saving, and investing for their future.

Real Estate Investing for

New Investors

Guide new investors through the intricacies of real estate investment, covering topics such as property selection, financing options, risk management, and maximizing returns.

Conflict Resolution for Landlords

Equip landlords with strategies and techniques to effectively navigate and resolve conflicts with tenants, promoting positive landlord-tenant relationships and minimizing legal disputes.

Project Management for Real Estate Investors

Teach project management principles tailored to real estate investments, covering planning, budgeting, scheduling, and execution to ensure successful property development projects.

Deal Analysis - How to Purchase the Right Property and Not Any Property

Train investors in the art of thorough property analysis, including market research, financial evaluation, and risk assessment, enabling them to make informed decisions and secure profitable real estate deals.

Generational Wealth - If You Only Knew What the Wealthy Knew

Delve into the strategies and principles employed by wealthy individuals to build and sustain generational wealth, providing insights into long-term financial planning, asset protection, and legacy building.

Budgeting 101

Offer a foundational course in budgeting, covering topics such as creating a budget, managing expenses, prioritizing financial goals, and adapting to changing circumstances.

Credit Score Power

Educate individuals on the importance of credit scores, how they are calculated, and strategies to improve and maintain a healthy credit score, empowering them to access better financial opportunities.

Debt Demolition

Provide practical strategies and techniques for managing and reducing debt effectively, empowering individuals to take control of their finances and achieve debt-free living.

Investment Insights

Offer valuable insights into different investment vehicles, risk management strategies, portfolio diversification, and long-term wealth accumulation strategies tailored to individual financial goals and risk tolerance.

Financial Goal Setting

Guide individuals in setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals and developing actionable plans to achieve them, fostering financial success and personal fulfillment.

Property Management Training - How to Manage Your Property and Your Tenants

Provide comprehensive training on property management techniques, including tenant screening, lease agreements, maintenance, and resolving disputes, ensuring smooth and profitable property ownership.

Money Mindset

Explore the psychological aspects of money management, helping individuals identify and overcome limiting beliefs, cultivate a positive money mindset, and develop healthy financial habits for long-term prosperity.

Financial Planning for

Life Events

Provide guidance on financial planning for major life events such as marriage, buying a home, starting a family, retirement, and unexpected emergencies, ensuring individuals are prepared to navigate these milestones with confidence and financial security.

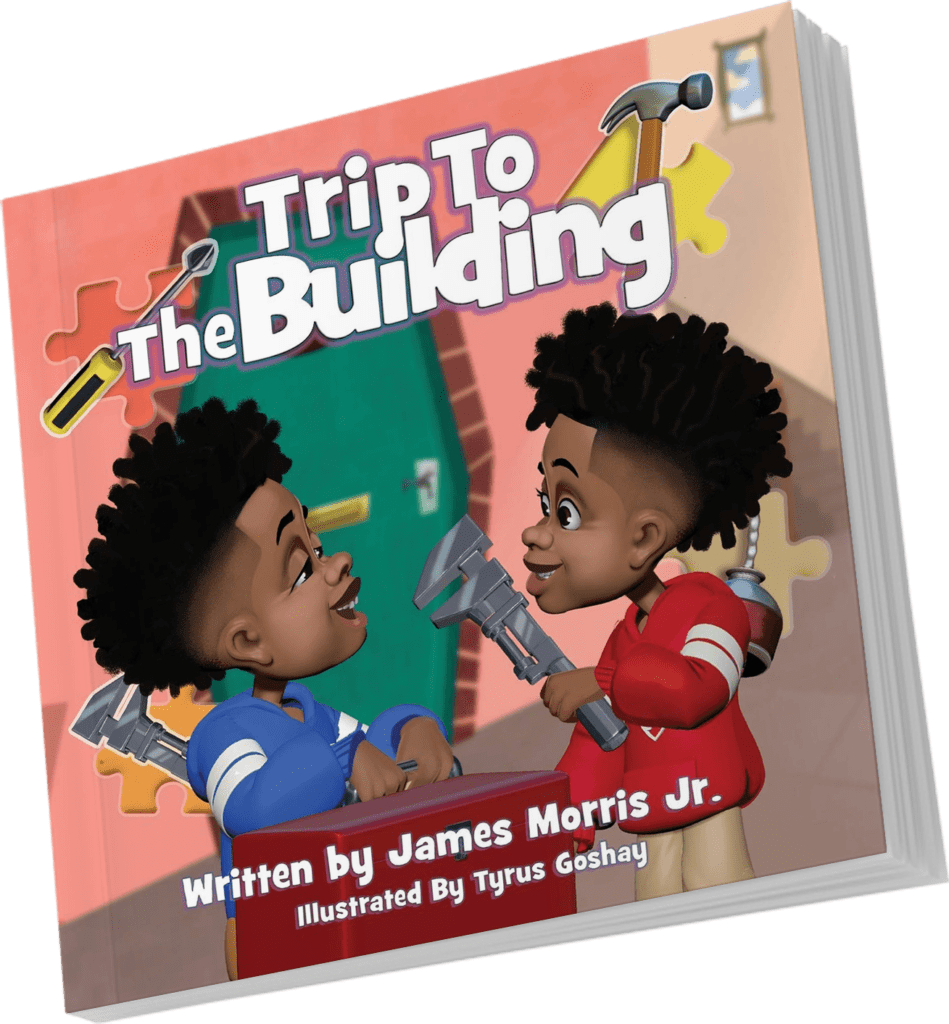

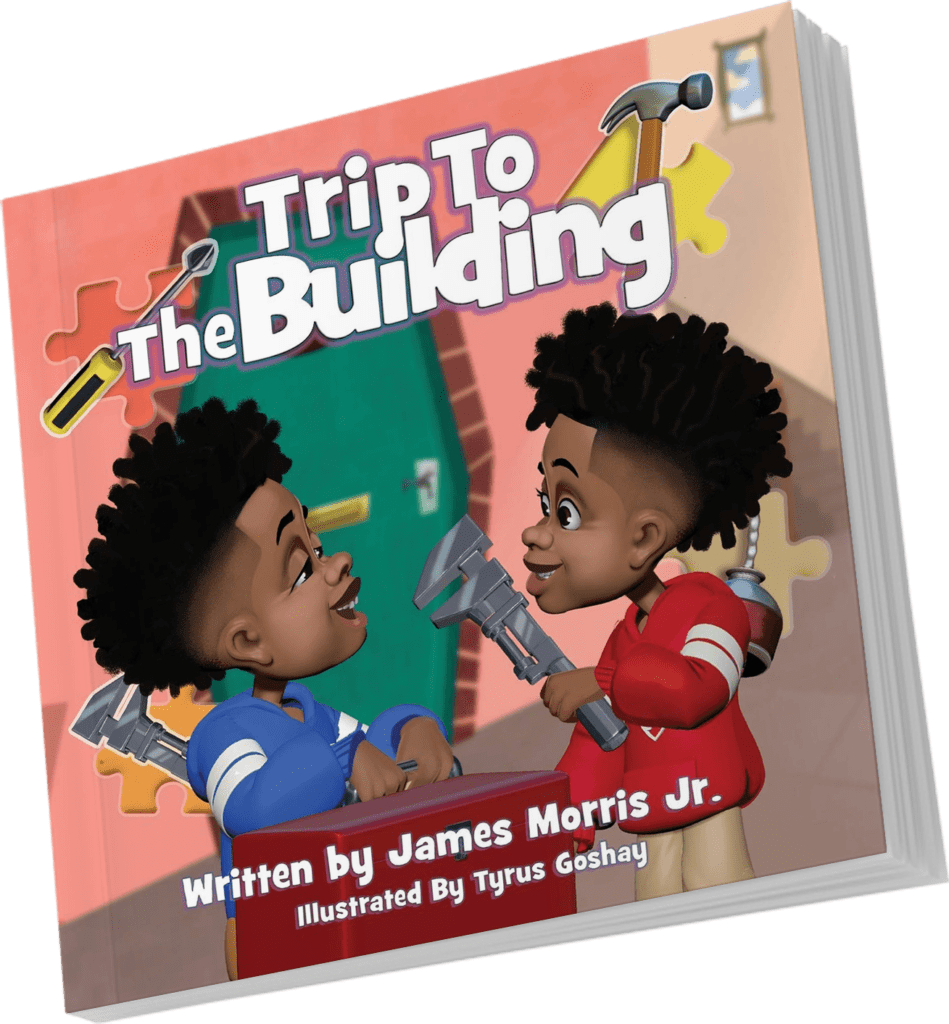

Explore the world of tools and real estate ownership with our free coloring pages inspired by the children's book 'Trip to the Building'! Join the young protagonists on an educational journey filled with discovery and excitement. From hammers to blueprints, these pages offer a delightful way for kids to learn about the tools and concepts involved in building and owning real estate. Spark creativity and learning with our engaging illustrations, perfect for young minds eager to explore the world around them. Download and print your coloring pages now, and let the adventure in learning begin

Looking to introduce your kids to the world of real estate and investing? Then look no further than Trip to the Building! In this delightful children's book, Mr. Morris takes his twin sons on a trip to their family's investment property to teach them all about how to take care of it and make it prosper.

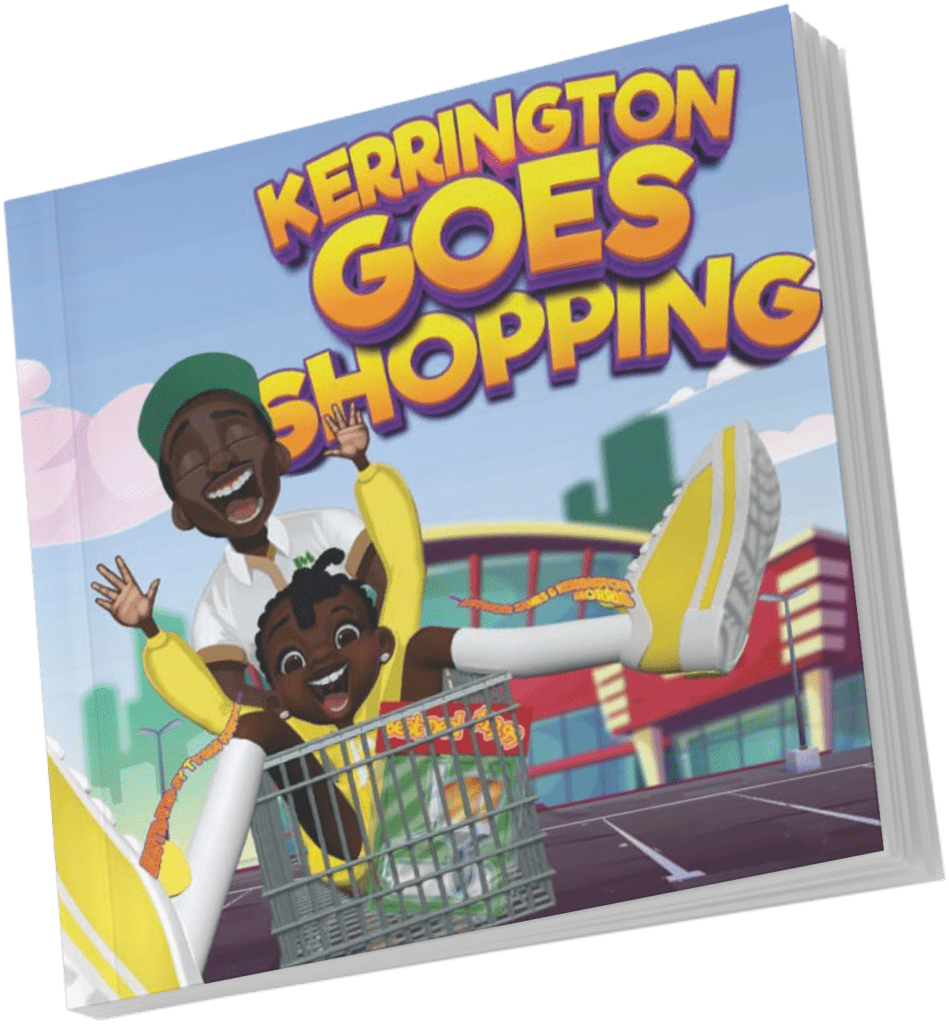

Kerrington Goes Shopping is the perfect children’s book for DIY enthusiasts. This heartwarming story follows Kerrington and her dad as they go to the hardware store to pick out paint colors and supplies for Kerrington’s new room. With a tight budget to stick to, they have to be creative with their choices but in the end, they manage to create a beautiful room that both of them can be proud of. Along the way, kids will learn about the importance of working together, being resourceful, and staying within budget. So grab your tool belt and get ready for some fun- because with Kerrington Goes Shopping, there’s no job too big or small!

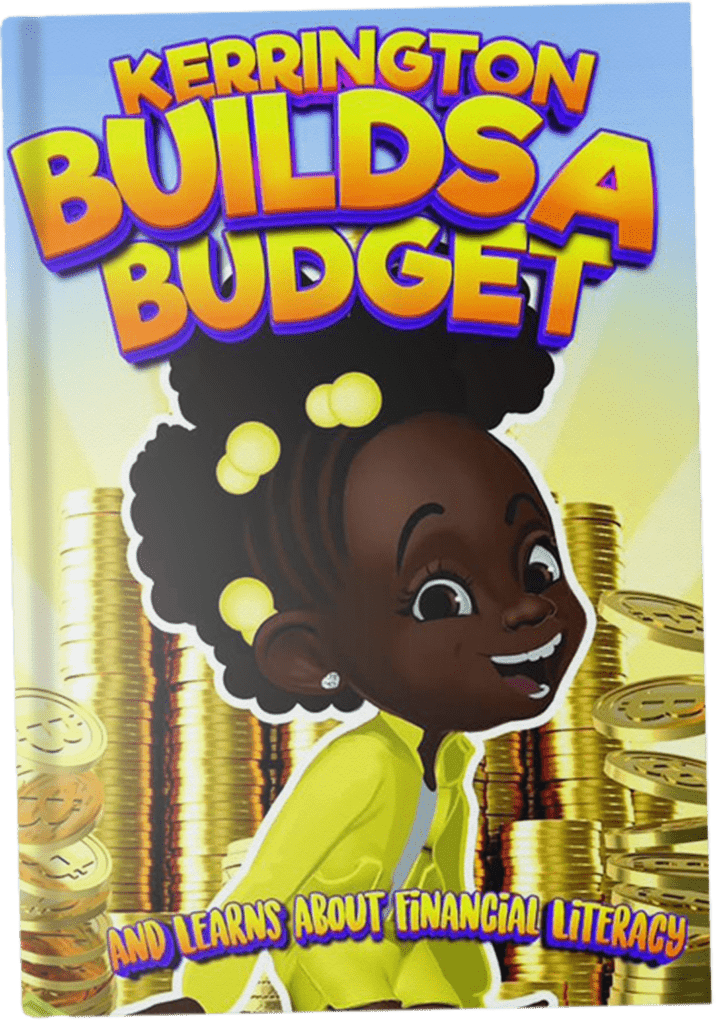

Kerrington Builds a Budget is an activity book that covers the importance of money, investing, savings, and having a budget. The book educates children and their caregivers about financia literacy using fun and engaging activities. Some of the topics covered include counting money, word searches, word problems, mazes and true or false statements. These activities are designed to encourage discussions about money and help children understand the concept of a budget. This book is a great tool for teaching children about responsible money management. It is also an excellent resource for caregivers who want to start discussions about finances with their kids.

I empower financially savvy individuals to cultivate passive income streams and create a lasting legacy of wealth by teaching them how to strategically invest in real estate, master budgeting techniques, and leverage their assets effectively for long-term financial success.

Getting Started with Real Estate investing as a First-Time Home Buyer

Real estate investing can be a rewarding venture, offering both financial returns and personal satisfaction. As a first-time home buyer, the journey may seem daunting, but with the right strategies and knowledge, you can navigate the process successfully. This guide will walk you through the essential steps, from understanding financing options to selecting the right property, and will provide insights into maximizing your investment through house hacking. By following these steps, you can turn your first home purchase into a strategic investment that lays the groundwork for financial independence.

Welcome to the James Morris Jr. Media Kit,

your comprehensive resource for learning about James' expertise in financial literacy, real estate coaching, and educational book readings. James, an economist for the federal government, has a rich background in real estate, having purchased his first investment property at 24 and growing his portfolio to include commercial multi-family properties. As a dedicated father and author of children's books, James is passionate about educating the next generation on financial empowerment. This media kit provides detailed information on James' background, achievements, and insights, making it an essential tool for anyone looking to engage with him for financial literacy workshops, real estate coaching sessions, or school book readings.