For many years, I had a dream to create an organization that would empower the world with financial literacy.

Creating a budget positioned me to purchase my first investment property at the age of 24.

After I had children my focus changed and in an effort to educate them I created something fun with a purpose and created books with characters that represented African-American families.

The final step was to create a workbook for families on how best to teach their children about financial independence matters too! Now you can color sheets, complete mazes, solve math facts, skip count, complete puzzles and word searches, and learn financial literacy as a family.

With just one vision and budget we are educating families - but through education we are now able to provide documentation on how you too can build your own financial success story!

WELCOME!

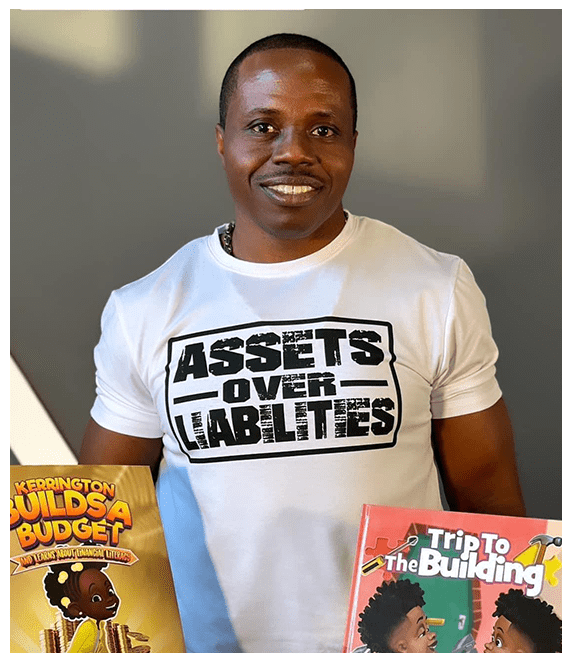

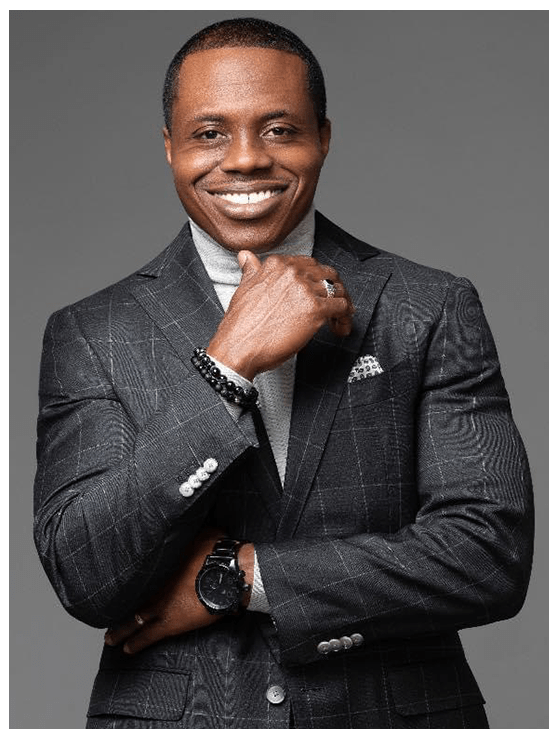

I'm James Morris, Jr.,

a passionate keynote speaker, real estate coach, and author dedicated to empowering individuals and communities through financial literacy and real estate investment. My journey began on the Southside of Chicago in the Auburn Gresham neighborhood, where I grew up in my uncle's three-flat building. Purchased in 1974 for $38,000, this multi-family property was more than just a home; it was a foundation for dreams and possibilities.

Living on the third floor, I witnessed firsthand the transformative power of real estate.

My uncle, a high school graduate with an unyielding vision, taught me invaluable lessons about hard work, financial independence, and the importance of giving back. He managed his property meticulously, handling repairs, collecting rents, and gradually building the financial stability that allowed him to purchase his first home in South Holland, Illinois.

But my uncle’s influence extended far beyond real estate. By the age of 35, he had built a diverse portfolio of businesses, including a car wash, restaurant, hair salon, and clothing store—all while maintaining a deep commitment to family and community. His mantra, 'If I'm not a millionaire by 35, then I never wanted to be one,' wasn't just about achieving wealth; it was about attaining the freedom to live life on his own terms, nurturing relationships, and fostering community growth.

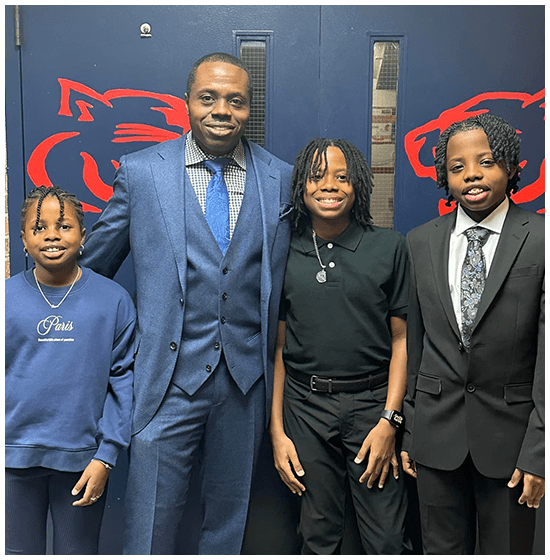

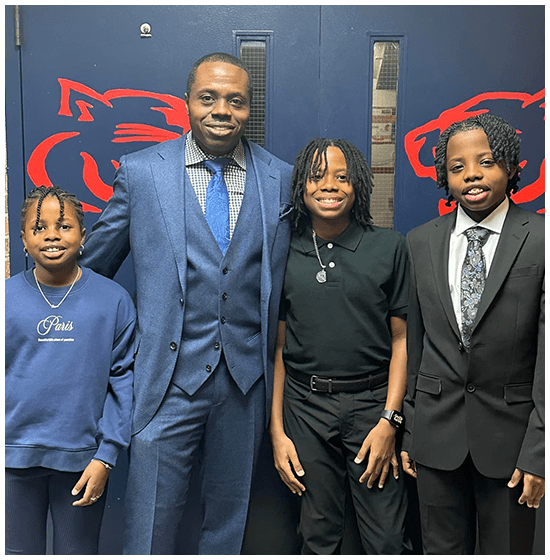

I am married to my wonderful wife and am a proud father of three incredible children:

twin boys Langston and Kamden, and a daughter Kerrington. Balancing family life with my professional pursuits has been both a challenge and a blessing, driving me to be the best version of myself in every role I play.

During the day, I work as an economist, applying analytical skills and financial acumen to understand and interpret economic trends. When I am not engaged in my work as an economist, I focus on my passion for real estate investing. This dual career allows me to merge my expertise in economics with practical real estate strategies, providing a comprehensive approach to financial empowerment.

My decision to invest in real estate was deeply rooted in the life lessons I absorbed from my uncle's experiences. Watching him navigate the world of property management and business ownership, I saw real estate as a powerful vehicle for financial security and community development. I realized early on that real estate wasn't just about buying properties; it was about creating opportunities, fostering stability, and building a legacy.

Seeing my uncle transform a simple three-flat building into a cornerstone of our family's financial wellbeing made a lasting impression on me. His ability to leverage real estate to support and uplift those around him demonstrated that investing in properties could provide more than just monetary returns—it could offer a means to make a meaningful impact on the lives of others.

Inspired by his success, I was motivated to follow in his footsteps and explore the vast potential of real estate investment. I wanted to not only secure my financial future but also contribute positively to my community, just as my uncle had done. This drive led me to become a real estate coach and keynote speaker, so I could share my knowledge and experiences, helping others realize that with the right strategies and mindset, financial freedom and community empowerment are within reach.

Through my journey, I have learned that real estate is more than an investment—it's a pathway to achieving dreams, fostering growth, and making a lasting difference. Let me help you discover the transformative power of real estate and guide you on your path to success.

The first step in controlling your finances is knowing how much money you “NEED to make” and how much money you “WANT to make.” My financial education began at the age of 13, thanks to my sister's foresight. She took the money from my savings account and invested it into two mutual funds. At the time, I was earning approximately $300-$400 per month working at my uncle's car wash.

Although I stopped making contributions to the investment fund while I was in college, the account's value doubled by the time I graduated. This growth provided me with the down payment for my first investment property—a red, four-unit building that I purchased in 2002 for $180,000. Today, that property is valued at $450,000 and grosses $4,700 per month.

This early exposure to investing and the power of compound interest taught me invaluable lessons about financial management and the importance of making informed investment decisions. It set the foundation for my real estate career and my commitment to helping others achieve financial freedom through strategic investing.

Why I Decided to Become an Author

I decided to become an author to create something meaningful and educational for my children. I wanted to teach them financial literacy in a fun and engaging manner. This led me to write a book for each of my children that not only resembled them but also took them on a journey to their first investment property. Through the stories, they learned how to create a budget and grasp essential financial concepts.

Each book became more than just a story—it became a product they could sell and use to start their own business. By doing this, I aimed to equip them with the tools and knowledge to understand money management and entrepreneurship from an early age. This endeavor not only helped me connect with my children on a deeper level but also allowed me to pass on the values and principles that have been instrumental in my own success.

By sharing these stories, I hope to inspire other parents and educators to find innovative ways to teach financial literacy and empower the next generation to take control of their financial futures.

Please contact James Morris, Jr. As a dedicated financial literacy coach, real estate coach, and children's book author, James is passionate about empowering individuals and families to achieve financial success and stability. He teaches financial literacy to both children and adults, ensuring everyone has the knowledge to make informed financial decisions. Whether you're looking to improve your financial literacy, navigate the complexities of real estate investment, or introduce your children to the fundamentals of financial education through engaging stories, James is here to guide you every step of the way. Reach out today to take the first step toward a brighter financial future.

- Book reading at a school

- Key Note Speaker Event

- Financial Literacy Workshop

- Real Estate Workshop

- Personalized Coaching

- Other (provide details below)

Please contact James Morris, Jr. As a dedicated financial literacy coach, real estate coach, and children's book author, James is passionate about empowering individuals and families to achieve financial success and stability. He teaches financial literacy to both children and adults, ensuring everyone has the knowledge to make informed financial decisions. Whether you're looking to improve your financial literacy, navigate the complexities of real estate investment, or introduce your children to the fundamentals of financial education through engaging stories, James is here to guide you every step of the way. Reach out today to take the first step toward a brighter financial future.

- Book reading at a school

- Key Note Speaker Event

- Financial Literacy Workshop

- Real Estate Workshop

- Personalized Coaching

- Other (provide details below)